All Categories

Featured

Table of Contents

60 68. "Comprehending the Tax Foreclosure Refine" provides an in-depth summary of Tax obligation Title Profits and Foreclosure procedures in material that accompanied a 2005 seminar. Lawful help for those dealing with repossession of the civil liberties of redemption in their building may be offered with Limited Help Representation. Minimal Support Representation (LAR) is offered to any kind of party that feels she or he can not manage or does not want a legal representative for the entire situation, however could utilize some help on a limited basis.

An investor that receives a tax lien certification collects a legal claim versus the property for the amount paid. A tax obligation lien can be put on a property since the owner hasn't paid residential or commercial property taxes.

The lien is removed when the owner pays the taxes however the local or county authority will at some point auction the lien off to an investor if they remain to go unsettled. A certificate is issued to the investor detailing the exceptional tax obligations and fines on the building after they've placed a winning quote.

Tax Lien Redemption Period

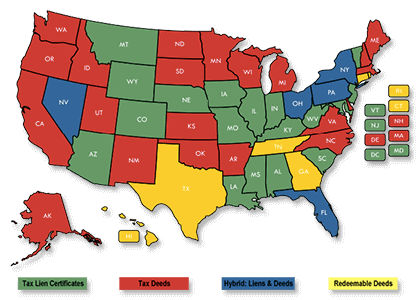

Not all states, counties, or towns offer tax obligation liens. The term of tax lien certificates generally ranges from one to 3 years.

Tax lien certificates can be bid on and won based upon the highest cash quantity, the cheapest rate of interest, or an additional approach - best states for tax lien investing. The sale of a tax lien certificate starts when the local federal government sends out tax bills to homeowner for the quantity owed on their real estate tax. The city government places a tax lien on the residential property if the residential property owner stops working to pay the tax obligations in a timely manner

Prospective buyers typically have to sign up and offer a down payment prior to participating. Capitalists bid on the tax obligation lien certifications at the public auction by supplying to pay the overdue taxes plus any kind of passion and charges. The winning prospective buyer receives a certification that represents a lien on the residential property for the quantity they paid.

The capitalist is usually able to foreclose on the residential or commercial property and take ownership if the proprietor stops working to redeem the certificate. A residential property needs to be thought about tax-defaulted for a minimal duration that depends on local law before it's subject to the lien and auction process.

A financier can possibly obtain the residential or commercial property for pennies on the buck if the homeowner stops working to pay the back taxes. Getting a residential or commercial property in this fashion is a rare incident, nevertheless, because many tax liens are retrieved well prior to the property goes to repossession. The price of return on tax obligation lien certifications isn't guaranteed and can differ depending on whether the building proprietor retrieves the certificate and whether the investor can foreclose on the residential or commercial property.

Adverse elements of tax obligation lien certifications consist of the need that the capitalist pay the tax obligation lien certificate amount completely within an extremely short duration, normally one to three days. These certifications are also extremely illiquid due to the fact that there's no additional trading market for them. Those that buy tax obligation lien certificates should also carry out substantial due persistance and research to guarantee that the underlying properties have actually a suitable evaluated value.

Investing In Property Tax Liens

There may be taxes imposed at the federal, state, or regional degrees depending upon the circumstances of the certificate. The revenue gained might undergo taxes if an investor gains passion on a tax obligation lien certification. Rate of interest earnings is normally reported on the investor's tax obligation return in the year it's made.

The financier will obtain the quantity paid for the certification plus the interest gained if the home owner redeems the tax lien certificate by paying the unpaid tax obligations and any kind of rate of interest or fees owed. The financier can take belongings of the property with repossession if the building proprietor is incapable to redeem the tax obligation lien certification.

Any type of revenue or gains made from the sale or leasing of the residential property will certainly likewise be exhausted, simply as with any other residential property. Some states and areas might also enforce taxes or charges on tax lien certificate financial investments.

Homeowner have the right to redeem a tax lien by paying the overdue tax obligations plus any kind of passion or costs owed. Mortgage liens can commonly just be pleased by repaying the entire underlying funding. Both liens are comparable in that they stand for debt that may be paid off however the hidden nature of that debt is different.

A city government entity may wish to market the lien to a financier with a tax lien certification sale after that time has actually passed. Mortgage liens can last for the period of the mortgage lending which may be significantly longer. Real estate tax lien investing may be a probable financial investment for those who desire to hold different financial investments and want direct exposure to real estate.

Investing In Tax Lien Certificate

It's usually suggested that you recognize tax obligation lien investing, understand the regional realty market, and study on properties before spending. There are several downsides to tax lien investing. It can be very easy to overbid on tax lien buildings or not totally understand the redemption durations. You might hold a lesser case to various other, a lot more highly perfected liens on the building.

Having a tax obligation lien against you doesn't necessarily harm your credit scores due to the fact that the 3 significant credit scores bureaus do not include tax liens on their consumer credit history reports. However property tax obligation liens might refer public document and the information that you owe an outstanding tax expense would certainly be extensively available to the general public.

A city government develops a lien versus the residential property and can auction off the civil liberties to that lien in the type of a certification if the taxes remain to go overdue. An investor that acquires the tax lien certification might have the ability to redeem their principal while additionally gaining some passion using penalty fees must the initial homeowner have the ability to repay the tax obligation lien in the future.

Tax obligation liens are an effective way to do this. In Arizona, an individual may acquire tax liens and gain up to 16% on their investment if they are redeemed.

Latest Posts

Tax Lien Investments

Real Estate Tax Lien Investing

Who has the best support for Real Estate Investing For Accredited Investors investors?